GOLD price moves lower as dollar firms, but still within 4-day range

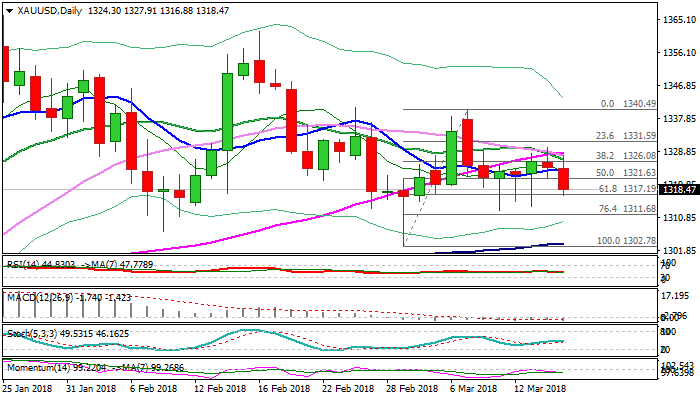

Spot Gold moved lower and holds in red on Thursday, turning focus towards key near-term supports at $1313 zone (base of four-day congestion).

Stronger dollar on better than expected US jobless claims and import data, pushed yellow metal’s price into lower side of four-day $1313/$1330 range.

Fresh easing weakened structure of daily techs as MA’s turned into bearish configuration and formed multiple bear-crosses (20/55 and 30/55), 14-d momentum moved to negative territory, while RSI turned south moved lower from neutrality zone, generating negative signal.

However, fresh bears need eventual close below cracked Fibo support at $1317 (Fibo 61.8% of $1302/$1340 upleg) and firm break below n/t congestion floor at $1313, to confirm an end of directionless phase and turn focus towards key supports at $1302 zone (01 Mar spike low / 100SMA / daily cloud base).

Caution on repeated failure at $1313 which could signal further extension of recent range-trading, as concerns about trade war keep greenback vulnerable.

FOMC policy meeting next week is in focus as key event which could generate fresh direction signal.

The Fed is expected to hike rates three times this year, with likely scenario of first hike occurring in March’s meeting, but traders will be looking for fresh signals about the pace of Fed’s action this year, as recent positive releases from the US signal the central bank could be more aggressive.

More hawkish tone for Fed would likely send gold price further down.

Res: 1321; 1328; 1330; 1338

Sup: 1313; 1311; 1307; 1302