Technical Outlook for yen Crosses 20/06/2016

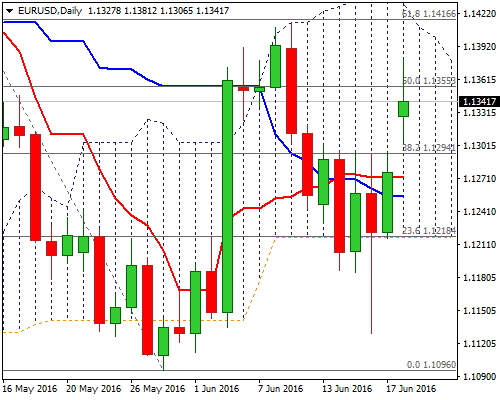

EURUSD

EURUSD

The Euro peaked at 1.1381 on fresh bullish extension in early Monday’s trading, after weekly start with gap-higher opening. Bullish weekly candle with long tail, signals strong upside momentum off last week’s low at 1.1129, with daily MA’s turning into bullish setup.

Fresh rally broke above weekly cloud top at 1.1340, moving towards the top of daily Ichimoku cloud which lies at 1.1413, reinforcing recent peak at upside rejection at 1.1414, also Fibo 61.8% of larger 1.1614/1.1096 descend at 1.1416.

Scope is seen for renewed attempt at strong 1.1416 barrier, with sustained break higher, needed to signal bullish resumption.

Daily close above 1.1305 (session low / broken Fibo 61.8% of 1.1414/1.1129 downleg, reinforced by daily 55SMA), is need to keep near-term bulls in play for final attack at 1.1416 breakpoint.

Recovery action stall or rejection at 1.1414 barrier would signal extended consolidation, with bullishly aligned near-term sentiment.

Return and close below 1.1300 handle would sour near-term structure and signal fresh weakness.

Res: 1.1381; 1.1416; 1.1445; 1.1492

Sup: 1.1334; 1.1305; 1.1285; 1.1255

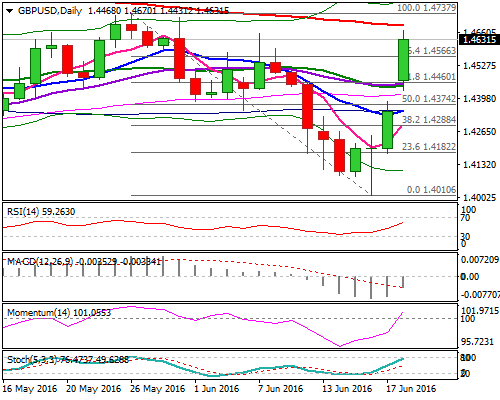

GBPUSD

GBPUSD

Sterling is in strong rally for the third day, established above 1.4600 handle and heading towards next strong barrier at 1.4689 (200SMA). Today’s bullish acceleration after gap-higher open, surged above the top of thin daily cloud at 1.4487, on fresh bullish momentum gained on relief from significant fall of Brexit fears.

Daily studies are turning into full bullish mode, with expanding 20d Bollinger bands, suggesting further upside action. Break above 200SMA is needed to open key short-term barriers at 1.4737/68 (26/03 May peaks, which mark upper breakpoints.

Buying dips remains favored, with good supports laying at 1.4542 (hourly trough) and 1.4522 (Fibo 61.8% of today’s rally).

Only return below daily low at 1.4431 would weaken near-term structure.

Res: 1.4670; 1.4689; 1.4737; 1.4768

Sup: 1.4613; 1.4587; 1.4542; 1.4522

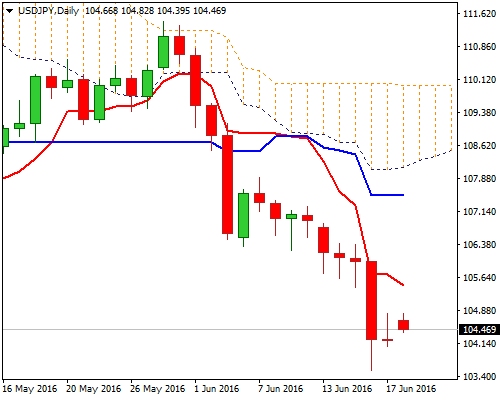

USDJPY

USDJPY

Japanese yen lost some of its safe-haven appeal, as renewed risk appetite on lower risk of Brexit, pushed USDJPY pair away from last week’s fresh low at 103.50.

Extension of recovery action after today’s 45-pips gap-higher open, was so far limited at 104.82, with near-term price action holding within 104.40/104.82 range.

Near-term studies show mixed setup, while structure of daily technicals remains firmly bearish and sees risk of fresh leg lower after completion of near-term corrective phase.

Session high at 104.82 marks initial resistance, followed by 105.20 (Fibo 38.2% of 107.89/103.54 downleg) and strong 105.45/53 resistance zone (falling daily Tenkan-sen / former low of 03 May), which is expected to cap upside attempts.

Only sustained break here would sideline persisting downside risk and open way for stronger recovery.

Res: 104.81; 105.20; 105.53; 105.71

Sup: 104.40; 104.20; 104.07; 103.74

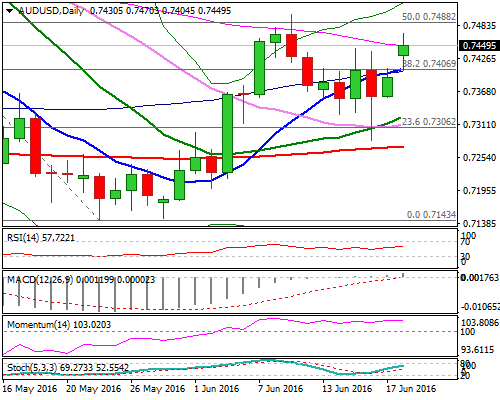

AUDUSD

AUDUSD

Aussie benefited on weaker US dollar and extended recovery from 0.7283 (last week’s low). Fresh rally after market opened with gap-higher, peaked at 0.7470 so far, eyeing strong barrier at 0.7502 (former recovery rejection / base of daily Ichimoku cloud which twisted lower).

This marks very strong barrier, break of which is required to signal resumption of the second leg of recovery from 0.7146 (30 May low), towards cloud’s top at 0.7542 and another strong barrier at 0.7569 (Fibo 61.8% of larger 0.7633/0.7143 descend).

The notion is supported by bullishly aligned daily Tenkan-sen / Kijun-sen lines and bull-cross of daily 10/100 SMA’s, which holds session low at 0.7405.

Alternative scenario requires sustained break below 0.7400 support zone (today’s low / Friday’s close / 10/100SMA bull-cross) to sideline attempts towards 0.7502 breakpoint.

Res: 0.7470; 0.7502; 0.7542; 0.7569

Sup: 0.7433; 0.7405; 0.7369; 0.7328, Daily Market Outlook