Technical Outlook for yen Crosses 16/06/2016

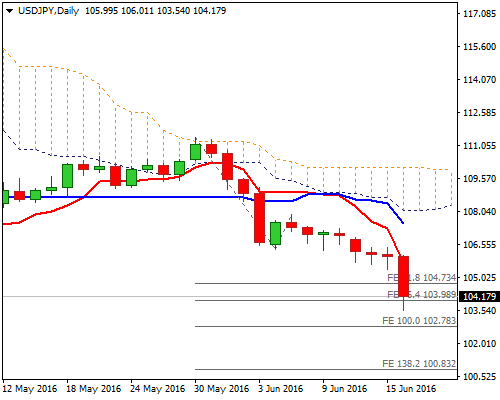

USDJPY

USDJPY

The pair dipped to fresh nearly two year low at 103.54, on bearish acceleration from session high at 106.00. Extension of bear-leg from 107.89 (07 June lower top) which also marks the wave C of larger descend from 111.43 (30 May peak), eyes 102.78 its 100% Fibonacci expansion, to validate wave principles for further weakness towards very strong support at 100.80 (FE 138.2% / weekly higher base of Feb / July 2014 consolidation).

Technical studies maintain firm bearish tone, with daily RSI entering oversold territory, which may signal corrective action in the near term.

No significant obstacles seen before 105.53 (former breakpoint) now reverted to strong resistance and 106.00 (session high, reinforced by falling daily Tenkan-sen), below which corrective actions should be limited.

Res: 104.62; 105.30; 105.53; 106.00

Sup: 103.54; 102.78; 101.90; 100.80

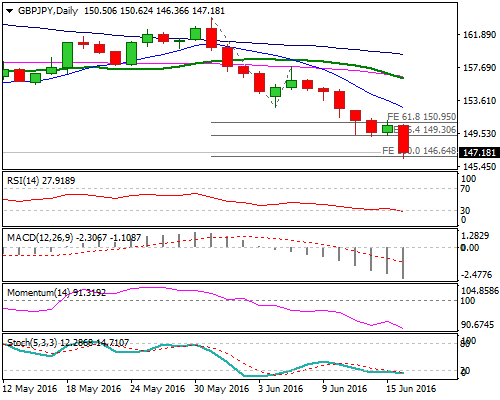

GBPJPY

GBPJPY

Sterling fell sharply against Japanese yen on strong risk aversion that increased demand for safe-haven Japanese currency. In addition, rising uncertainty ahead of Brexit referendum, keeps British pound under pressure.

Today’s trading is so far shaped in long red candle, on strong acceleration lower, triggered by final break below former strong support at 151.61 (03 Apr former low).

Fresh weakness broke below next strong support at 148.20 (Fibo 61.8% of larger 118.77/195.81 2012/2015 ascend), with daily close below here required to confirm strong bearish stance.

The cross posted new over 3-years low at 146.36, just ahead of next target and strong support at 145.82 (monthly Ichimoku cloud base).

Consolidative action above 145.82 could be expected as daily RSI / slow Stochastic are entering oversold territory and profit-taking may push the price higher.

Hourly lower base at 149.20 marks initial resistance, ahead of psychological 150 barrier and former breakpoint at 151.61, which is expected to cap extended rallies.

Res: 149.20; 150.00; 151.15; 151.61

Sup: 146.36; 145.82; 143.35; 142.35

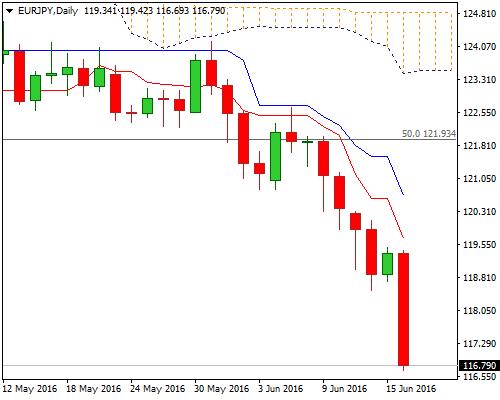

EURJPY

EURJPY

The pair broke below strong support at 119.88 (monthly Ichimoku cloud base) on today’s fresh extension of larger downtrend from 149.76 (Dec 2014 peak).

Extension of the Wave C which commenced from 141.04 lower top, cracked its target at 117.11 (FE 100%), opening way towards next significant support at 115.35 (Fibo 61.8% of 94.10 / 149.76 2012/2014 rally).

The wave is capable to travel towards psychological 100.00 support and 107.97 (FE 138.2%), as strong bullish sentiment drives Japanese yen higher.

Meantime, technical corrections on oversold daily studies may interrupt bears. Broken monthly cloud base, now acts as strong resistance at 119.88 and is seen as ideal cap for corrective rallies.

Res: 117.45; 118.50; 119.88; 120.35

Sup: 116.69; 115.35; 113.55; 110.00, Daily Market Outlook