GBPUSD remains at the back foot ahead of data

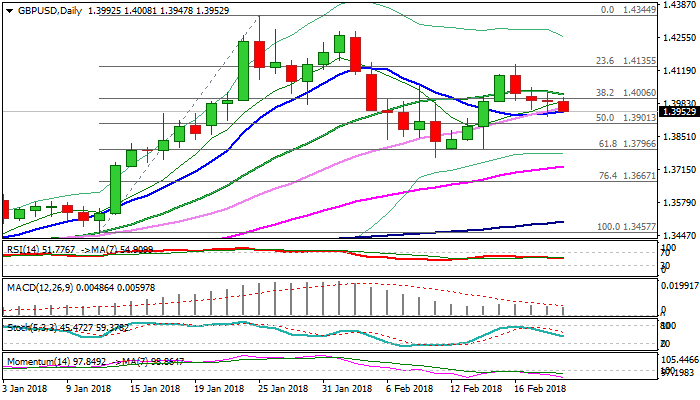

Cable extends weakness on Wednesday’s after mixed previous day’s action ended in long-tailed Doji and signaled indecision.

Pound was lifted by media comments on Brexit, upside attempts above 1.40 handle were short-lived.

Fresh weakness tests again 10SMA (1.3952) which contained yesterday’s dip (Tuesday’s spike low lies at 1.3931) and sustained break lower is needed to signal further easing towards 1.3909 (Fibo 61.8% of 1.3764/1.4144 upleg).

Bearishly aligned daily techs are supportive but need further negative signals for confirmation.

UK jobs data are key event for pound today (avg. earnings are expected to remain unchanged at 2.5% in Dec along with unemployment rate (4.3%), while jobless claims are forecasted to fall in Jan (2.3K vs 8.6K in Dec).

A number of speakers from BoE today and FOMC minutes are expected to create firmer signals for sterling.

Res: 1.3977; 1.4018; 1.4049; 1.4104

Sup: 1.3952; 1.3931; 1.3909; 1.3854